The Quickly Maturing Cloud Market

and President of

Strategic Contact.

The “Cloud” contact center technology market is maturing and the vendors are all in. You may be lured by the “fast and easy” message, but serious buyers need to be well informed to seize the opportunities and avoid pitfalls. This article is the first in a two-part series, focusing on the market and vendor landscape, with some key considerations in the cloud pursuit. Next month, I will cover managing a cloud solution for success, including the SOW, SLAs and vendor management.

Not All Clouds Are Equal

It’s important to get a clear understanding of what anyone means when talking about cloud contact center technology solutions. In most cases, cloud is multi-tenant, meaning multiple companies access the same platform, isolated from a software and operational perspective. Single tenant solutions with a platform and software dedicated to one company may be referred to as hosted or private cloud.

Dig a bit deeper and you may see variations on cloud solutions based on software “instances.” With server virtualization, it’s all about the software, not (shared) hardware. You may find shared software with isolation per user, or a dedicated software instance. While many don’t care, it can matter mightily to someone concerned about control and security. In particular, with single tenant (hosted), you have more control over software changes (releases, patches), storage and data security than multi-tenant.

Many other variations exist under the same names. The platform may reside in your data center(s), the vendor/VAR data center(s), or in third-party data center(s) like Amazon Web Services. If it’s in your data center but the vendor is selling it as a hosted or private cloud solution, it’s really more like a “managed service” (see “Managed Services: Easy to Want, Hard to Buy,” Tech Line, February 2016). You may have all equipment in these data centers or some on premise, which is often referred to as “hybrid.” Examples of onsite equipment include network gateways, media servers or recording devices. Another key variation is the type of network connectivity—MPLS or other private/dedicated network connectivity or using public Internet. Internet may enable fast and easy cutover, offering flexibility and low cost, but make sure you’re OK with any performance and security risks that go with it.

Many other variations exist under the same names. The platform may reside in your data center(s), the vendor/VAR data center(s), or in third-party data center(s) like Amazon Web Services. If it’s in your data center but the vendor is selling it as a hosted or private cloud solution, it’s really more like a “managed service” (see “Managed Services: Easy to Want, Hard to Buy,” Tech Line, February 2016). You may have all equipment in these data centers or some on premise, which is often referred to as “hybrid.” Examples of onsite equipment include network gateways, media servers or recording devices. Another key variation is the type of network connectivity—MPLS or other private/dedicated network connectivity or using public Internet. Internet may enable fast and easy cutover, offering flexibility and low cost, but make sure you’re OK with any performance and security risks that go with it.

The scope can vary from a full suite (see the sidebar “CLOUD SOLUTION FUNCTIONALITY”) or a subset. Key questions here are whether you need PBX or Unified Communications (UC) functionality, and whether you will use what you have or look at Skype for Business.

As you can see, the cloud solution environment is highly variable! The variations are not just vendor-driven; buyers create a diverse demand. While we might all wish it were simpler, it’s not, so make sure you have clarity when discussing the cloud with vendors or others.

Cloud Solution Functionality

Cloud solution functionality can vary widely depending on the vendor. The major players continue to fill out their “suite” of capabilities—whether through acquisitions, partnerships or development. When pursuing cloud solutions, make sure the scope is clear and prequalify vendors accordingly.

- Call routing (including skills) and reporting for inbound voice calls) as the baseline

- Includes supervisor and agent desktop tools (clients), usually web-based

OPTIONS:

- Other channels including email, chat, co-browse, social media, text/SMS

- Outbound calling—including preview, progressive and predictive dialing

- Callback Queuing

- IVR for prompting and messaging at a minimum

OPTIONS:

- Self-service

- Speech recognition

- Proactive notification/alerting

- Post-call survey

- Integration for CTI screen pop or other capabilities

- Performance tools

- Call recording as part of thebase functionality

OPTIONS:

- Screen capture

- QM

- WFM

- Analytics and dashboards/scorecards

- Other advanced capabilities such as eLearning or coaching tools

- PBX for enterprise telephony

- Unified Communications

- Includes presence and Instant Messaging

- Knowledge Management

- CRM (“mini” versions or full-blown) or CRM integration (aka “connectors”)

The Market Landscape

Regardless of labeling, cloud contact center technology solutions are maturing quickly, and there is fierce competition. “True cloud”—a standard multi-tenant offering—is the most common for cloud-only providers and is the direction for many of the premise solution vendors that are now offering cloud options.

The market reflects some of the key advantages buyers are seeking and sellers want to capitalize on. It starts with the message of “fast and easy.” Get it installed quickly—as short as hours (or days). Easy goes hand-in-hand with speed. Fast set up and configuration is perhaps true for very small and simple centers or new centers, but only when using Internet connectivity. It is less true for existing centers with any complexity, including plans to improve calls flows or take advantage of new capabilities (it takes time to design and add business value!), integrate, or set up MPLS or other private network connectivity. But the good news is a cloud solution can be faster than a premise solution (e.g., a few months vs. 6-12 months).

Users don’t control if or when the upgrade occurs, and (ideally) don’t notice or care other than the potential to take advantage of new capabilities. In some cases, upgrades lead to options that can be activated when the user is ready. However, this innovation requires a “hands-off” mindset from IT as well as the agility to respond when a change impacts other facets of the operation. For example, it has implications for training and communication with frontline, supervisory/ management, and administrative users when the user interface changes. The caution around this seeming advantage of always-evolving and up-to-date solutions is that in an integrated, complex environment, they do not live in isolation. So, IT must still be involved and have processes for reacting to ongoing changes to ensure things don’t “break” as a result.

|

How Much Does it Cost? You know the answer is “it depends!” If you can implement in hours, you expect no up-front costs, and the vendors have fueled the fire with free trials. But as indicated, not all cloud solutions are created equal, and it’s not always easy and fast. So here are a few key cost considerations:

|

Another lure of cloud is enabling resources anywhere, anytime, whether home agents, outsourcers, international locations, staff for peaks or disaster recovery. Such agility can be particularly easy when remote access simply requires a log-in through a web client. In such circumstances, cloud can be a particularly good fit for non-voice agents handling email, chat or text/SMS. Those handling voice can use anything as the voice path: a PBX line, home phone line, mobile phone or even Internet voice. Those who want no risk to the voice quality will want this to be a land line.

Anytime/anywhere agents are not exclusive to the cloud; it can be done with premise solutions as well. However, the cloud offers licensing agility that can go hand-in-hand with the location flexibility. Some vendors will simply charge you by month for the maximum number of licenses engaged, even if deployed on the fly. Others may require advance notice on peak numbers and/or only offer discounts on annual commitments. While the market seems to be continually evolving in this regard, perhaps due to the high degree of competition, offerings are not always as agile as they appear.

Many centers lack business continuity and disaster recovery configuration and plans, so may seek the “built-in” BC/DR of a cloud solution. And they may well get it if they select the vendor accordingly and, in some cases, pay for an associated level of service.

Beyond these often compelling attractions, presother long-standing cloud drivers include the move to an operational expense (Opex) model and less reliance on limited or overburdened IT resources. IT isn’t totally off the hook though. Integration, network and support responsibilities are greatly reduced but cannot be offloaded fully to the vendor.

“In spite of these many pluses, the “true cloud” is not necessarily what everyone wants or needs.”

In spite of these many pluses, the “true cloud” is not necessarily what everyone wants or needs. An abundance of hosted options still exist to address fears that swirl primarily around security and control. Single tenant solutions will continue to appeal to larger, more risk averse companies that migrate a premise solution, want more control and maintain IT involvement. Hosted is not as “fast and easy” or agile, but still delivers the Opex, reduced IT demands and some level of the other benefits noted above.

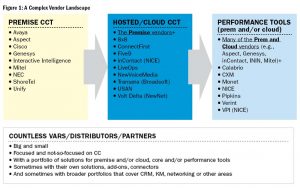

The Vendor Landscape

With all these advantages and a fast-changing world where fewer companies have interest in running data centers, servers, networks and other infrastructure, or applications outside of their core business, the vendors are all in.

A solid, experienced set of cloud-only players set the competitive stage, led by companies like 8×8, Five9, inContact (recently acquired by NICE), LiveOps and Transera. These companies have enough market presence to make Gartner Magic Quadrants or other analyst evaluations, but there are a plethora of options for those willing to accept a little more risk, such as: ConnectFirst, NewVoiceMedia, Ring Central, Talkdesk (and too many others to list, as well as new ones still emerging). Some come from a “carrier” background, so offer network, too, whether as software providers (e.g., inContact, 8×8, USAN) or Value Added Resellers (e.g., Century Link, Verizon). Some started with basic enterprise telephony but offer contact center functionality, as well (e.g., 8×8, RingCentral).

Vendors that offer premise solutions are strongly committed to offering cloud solutions as well, directly and/or through partners. Most of these have multiple offerings and started from a hosted approach, often with more custom solutions. They may leverage the same platform, but had to ensure multi-tenancy to support a true cloud offering, not just hosted or private cloud (e.g., Avaya and Cisco through partners). Some have bought their way into the cloud space (e.g., Genesys, Mitel, ShoreTel) while others have built their way in (e.g., Interactive Intelligence—first with their Communications as a Service (CaaS) hosted (or private cloud) option leveraging their CIC premise solution, and now with PureCloud as a totally different architecture and their entry to the true cloud world).

To be a serious contender, these vendors have to offer performance tools, whether their own, through partnerships, or some combination. This is an area where we have been seeing acquisitions (e.g., Avaya of KnoahSoft, inContact of Uptivity, Mitel of Oaisys, NICE of inContact) and expect more.

FIGURE1 shows the main types of players in the vendor landscape and some representative companies

Note the many caveats—it’s a wide-ranging market and there are many more players and frequent changes.

|

Choose Your Partner Carefully Here are some key considerations in selecting not just a solution, but a partner that will be critical to your success:

|

We need to keep one more set of vendors in mind: CRM players such as Salesforce.com, ZenDesk, Microsoft, Oracle and SAP. Centers don’t typically use these for voice, even though some have started to offer these through acquisition (SAP, Oracle) or development (ZenDesk). They all partner and integrate with a variety of voice options. However, some centers use CRM to handle email, chat or social media—albeit less robust in routing and reporting capabilities or integration with the other performance management tools compared to what the “typical” contact center technology solution has to offer. This is an area to watch as this market develops. Will there be mergers and acquisitions? Or will these companies add voice capabilities? The current model could continue with vendors working together but it presents a difficult decision on what media gets handled where, with overlapping functionality for non-voice routing and reporting. Each option offers pros and cons (e.g., single multimedia routing and reporting engine versus more direct integration of contact tracking in CRM). Stay tuned on this issue!

The Educated Buyer

It’s an exciting time for the rapidly maturing market of cloud contact center technology. If you’re a buyer, you can feel confident that you will find a solution that is a good fit, from a trustworthy vendor who will stand behind their solution. At the same time, given the level of competition and change, it’s important to bring a dose of skepticism and caution to the task. Check out the sidebars on cost and selecting your partner. We hope this primer helps you to be an educated shopper and buyer. Next month, we’ll provide more input so you can be an educated user and vendor manager, as well.

Lori Bocklund is Founder and President of Strategic Contact.