ROI, ROI, Wherefore Art Thou ROI?

and President of

Strategic Contact.

Just for fun, let’s start this technology article with some English literature and vocabulary. I chose the title hoping it would capture your attention, but there’s method to my madness.

Most of us think that “wherefore” means “where”—as in, Where is the Return on Investment (ROI)? But Shakespeare’s Juliet said, “O Romeo, Romeo! Wherefore art thou Romeo?” shortly before bemoaning the family feud and pondering what’s in a name. So wherefore means why—as in, Darn you Romeo, why did you have to be a Montague (and me a Capulet)? This would all be so much simpler if…

Let’s apply that meaning to our challenge athand: Why is there an ROI when you buy contact center technology? It seems like a simple question, but one many centers struggle to answer. And why do you need to develop a business case to show technology value? You must make the case initially to get funding, and then, ideally, show that you delivered on that promise. Those seem like strong reasons to me!

Part 1 of this article series set the stage by showing the structure of your contact center costs and the role of technology in that cost structure (see “Contact Center Costs and the Role of Technology,” Pipeline, October 2018). When you look at the overall operating budget of a center, the technology is a relatively low cost (4%-12% of the total in the models we ran) and it can make a big impact on the big piece of the cost, labor (68%-77% in our models). In this closing chapter of our series, I’ll dig deeper into the “why” of your contact center technology, providing great reasons for pursuing the right technology.

Part 1 of this article series set the stage by showing the structure of your contact center costs and the role of technology in that cost structure (see “Contact Center Costs and the Role of Technology,” Pipeline, October 2018). When you look at the overall operating budget of a center, the technology is a relatively low cost (4%-12% of the total in the models we ran) and it can make a big impact on the big piece of the cost, labor (68%-77% in our models). In this closing chapter of our series, I’ll dig deeper into the “why” of your contact center technology, providing great reasons for pursuing the right technology.

Three Key Paths to ROI

Three potential paths to business case development provide opportunities to deliver that elusive ROI:

- Gain Efficiency

- Drive Revenue

- Improve Service

The first two are the easier, more compelling ways to show an impact, so grab onto those whenever you can. The Service path requires a little more work and a bit more faith. Here’s the bonus: These paths are not mutually exclusive.

We’ll start with efficiency since so many centers are looking for ways to cut, or manage, costs and because that big labor slice of the cost pie provides a ripe target. Revenue is important as some centers focus on sales, or upselling, but also because many “service centers” play a role in acquiring or retaining customers. Speaking of service, improving the customer experience is a big part of many centers’ mission, so we want to look at how that can translate into dollars as well.

Efficiency

Other changes also reduce handle time:

Less time spent in the identification and verification steps

Less time overall as processes are streamlined or manual steps are eliminated through automation

Less time putting customers on hold searching for answers

Less time in wrap-up through automation capturing important information

All of these opportunities can be modeled and lead to a direct hit on the labor costs. For example, when you run Erlang models with the “what if” of lower volumes and handle times, you see how that reduces staff demands. Then you have to look at whether you would truly reduce staff, hire slower as you grow, or let attrition naturally bring the cost reduction to fruition.

Some centers literally put a dollar value on a second as they think about how to reap the benefits of reducing handle time. My example from Part 1 of this series (see October 2018) of a 5% handle time reduction from Knowledge Management (KM) translates to about 1.4 cents per second. For the volume in that model, each second reduction in handle time is worth over $34,000 annually.

Revenue

Changes in the center can drive revenue through sales (dollars) and customer acquisition (numbers of customers). Upsell and cross-sell have become commonplace in both sales and service centers, with metrics such as revenue per order or per contact. Centers may also impact customer loyalty, leading to greater customer value measured by products per customer, average customer value per year or for a lifetime. Retention is very impactful for environments with high customer churn, so reducing churn rate can be translated into revenue based on average customer value.

The impact of each of these can be significant, even if efficiency appears to decline. Here’s one example: a bank implemented a new technology environment, including CRM with customer segmentation, workflows, and scripts to identify affinity products for the segment or customer situation. The Director exulted, “Talk time is up and I’m thrilled!” because he could see the financial metrics increasing with more products (and therefore revenue) per customer.

Service

Service improvements, measured through higher customer satisfaction rating or Net Promoter Score, for example, can deliver soft benefits with ripple-effects into many areas. Some of the impacts can be translated to tangible benefits, especially if they deliver revenue.

In defining ROI for technology that focuses on the customer experience, carefully define assumptions or “what if” scenarios that can be approved by leadership. If they buy into the premise, then you can play out the financial analysis that shows the benefit.

For example, I have seen a B2B company make the case for their entire technology strategy by showing that improved contact handling would lower churn in their distributor ranks by at least 5%. This business case considered distributor input on what they needed from the center to help their business succeed and identified the technology to enable that.

Less Direct But Important Benefits

Two other areas can drive measurable benefits. The first is the resources to support and manage technology, whether they are in the center or in IT. The second is all the factors around hiring, retaining, training and guiding frontline agents to proficiency. In centers with high turnover or long training or proficiency cycles, these can add up. Improvements in these areas can also have a soft benefit in terms or morale, potentially contributing to service, revenue and efficiency.

Support and IT

The maintenance and management of technology is a cost of doing business. While it is not always attributed to the contact center’s budget, it is a real cost to the company. Perhaps more significantly, the constraints of IT resources can hold a center back from reaping the benefits of contact center technology. We often see things that idle on “wish lists” because IT can’t get them to the top of their “to-do” lists. Technology solutions that free the center up from IT dependence can be enablers of other benefits. Cloud solutions are popular for many reasons, but this is a big one—the operation can pursue new capabilities with less dependence on IT resources and timelines.

Staff Factors—Hiring, Retention, Training, Proficiency, etc.

As noted in Part 1, you can put a cost on hiring and training each agent. Lower productivity while new staff ramp up to proficiency can also be calculated. Changes that reduce attrition, shorten training and/or speed up time to proficiency can be modeled and the new, improved world compared to the baseline. For example, KM could drop training from four weeks to three weeks for each new-hire, and maybe move time to proficiency from an average of four months to two months. Those savings can add up in an environment with 25% or higher turnover. Hiring the right people to start can also be quantified as it will improve all those factors. Lower attrition is the starting point and then training and proficiency impacts follow.

Show Your Why with ROI (or Other Financial Metrics)

As you submit budget requests, you need to make the case for technology change, whether through frontline staff savings, increased revenue, less support or IT cost, or lower overhead to get staff onboard and effective. And you need to be realistic—this is not “flipping a switch” when you put in new technology. Be sensitive to how long it will take for frontline, leadership and/or support staff to get comfortable with a technology. Consider if you have a “hit” on performance that makes things worse before they get better. CRM is a classic example of this—handle times can go up, which may be OK if the revenue offsets it, or may be a temporary thing as people get used to using the tool and you tune workflows and processes.

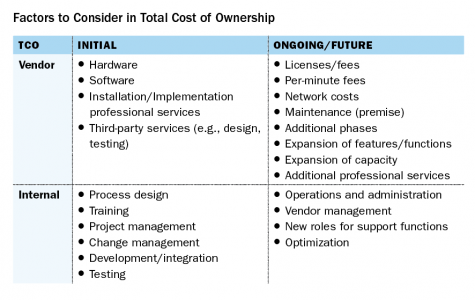

Start with the baseline costs, as outlined in Part 1 of this article series. Then develop the model with the new cost for the investment, while also calculating any benefits you see. The investments must represent Total Cost of Ownership (TCO), as outlined in the table below. Keep in mind that with cloud, the initial costs with the vendor may be very low, so that can change the way we look at technology investment and payback, which historically dealt with high upfront costs. After you develop your TCO, you can compare the before and after based on the changes you foresee. Remember efficiency (or service improvements that drive efficiency) translates to savings, and revenue can be compared to the investment to determine if the cost increase is outweighed by the additional revenue.

A return on investment shows the percent payback of an investment—gain calculated by subtracting the cost from the benefit, divided by the investment. You need to select a time period to show ROI. Again using my KM example from Part 1, the ROI is 658% for a year, assuming no upfront costs and the agents are settled in with using the tool and gaining the handle time benefits (and the center has reduced staffing). Obviously that very attractive number can be compromised with the transition at the start, but the benefit is still persuasive.

Alternatively, you can look at payback period: how long it will take before the investment pays off, or the time at which you break even and begin to benefit more from the investment than it costs you. If you are in a period of growth, with rising costs, slowing staff increases with efficiency can be compelling. It gets even better if there is a new revenue component. A full analysis requires a look at cash flow (including discounts that factor in the time value of money). Your finance department may have models or you can work with consultants to baseline your environment and analyze the changes you will make.

Keep in mind that you don’t necessarily have to identify and quantify each benefit. Focus on the “big hitters” and quantify the ones that are most easily defended. Then determine if you can reach a positive outcome (and look for more if you haven’t yet reached the goal!). You can always list other benefits to show there is even more upside.

Finally, don’t forget to close the loop and show that you reaped the benefits you projected. Allow time to settle in, recognizing benefits don’t come day 1 (and they may not come until 90-180 days out!). Follow through on the commitments made, showing what you achieved, and what you learned. With a new rigor around investment value, chances are your next request will get more serious consideration as you show the reasons technology is worth the pursuit.

Lori Bocklund is Founder and President of Strategic Contact.

– Reprinted with permission from Contact Center Pipeline, http://www.contactcenterpipeline.com