Contact Center Challenges and Priorities for 2021: A Year Like No Other

It’s our sixth year of asking two simple questions of contact center professionals: What are your biggest challenges today? What are your top priorities for the new year? If you are a fan of this series, you may remember 2020 was going to be “The Year of the Agent”! I innocently looked forward to “a new year, a new decade, and all kinds of opportunities to talk about perfect vision!” Well, it turns out the vision was terribly clouded by a global pandemic that disrupted everyone and everything, contact centers included. If I were to pick a theme this year, it would be agility. Not enough centers had it, and going forward, everybody needs it.

This year, we had 261 participants, each of whom shared up to three challenges and three priorities. As usual, we tried to keep the lists consistent for year-to-year comparisons, but we always make a few tweaks. This year demanded a look at home agents as we knew most of our participants would be in that mode, whether they liked it or not.

This year, we had 261 participants, each of whom shared up to three challenges and three priorities. As usual, we tried to keep the lists consistent for year-to-year comparisons, but we always make a few tweaks. This year demanded a look at home agents as we knew most of our participants would be in that mode, whether they liked it or not.

Results Like No Other

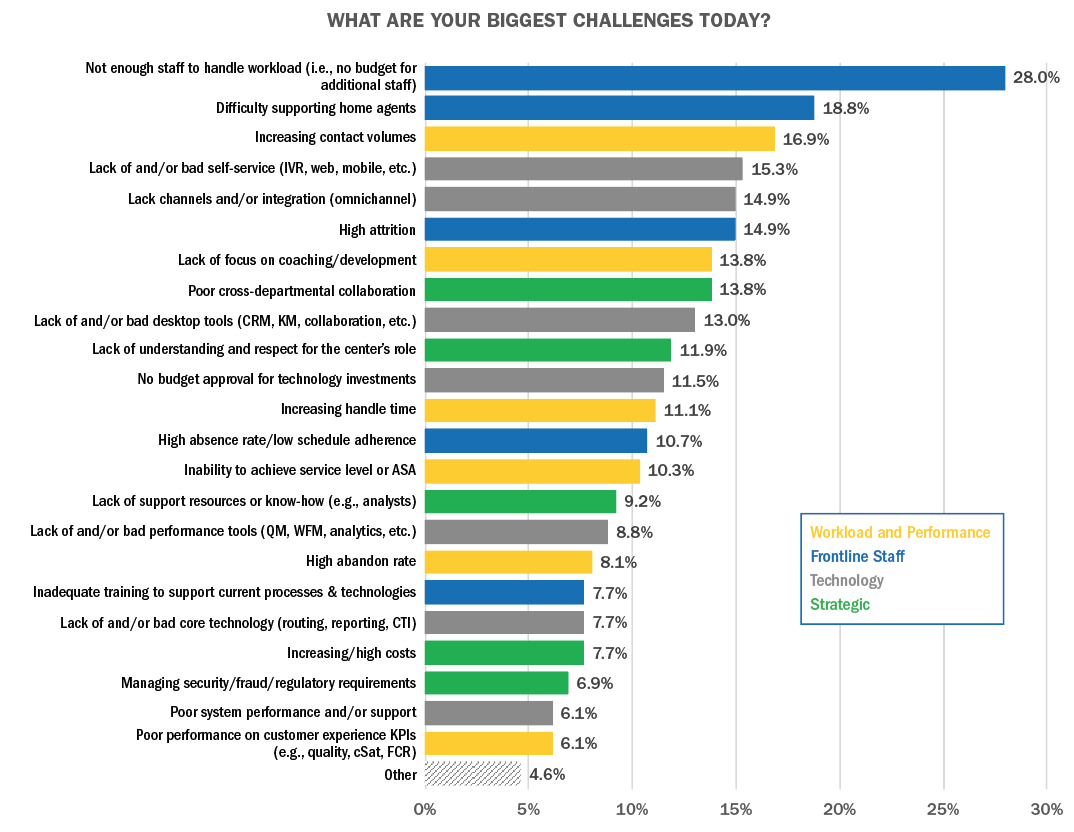

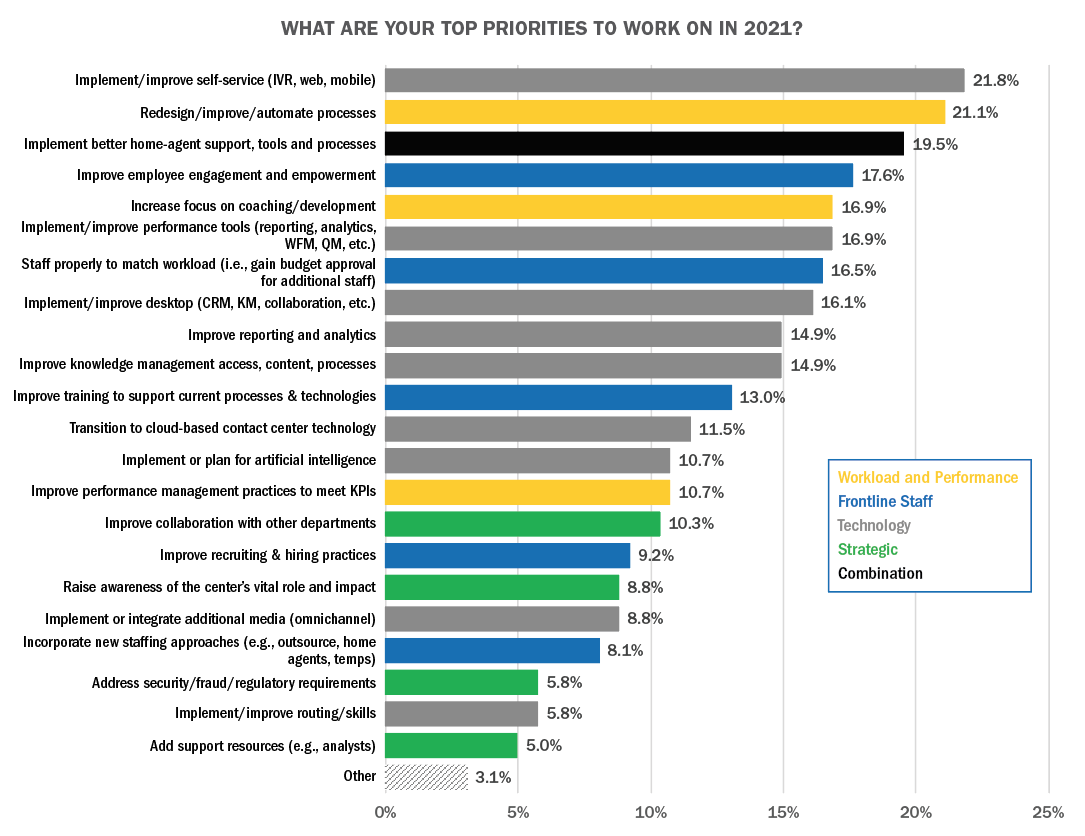

You can see the overall results in Figures 1 and 2. I want to highlight some of the biggest messages and changes (and I mean big!):

Challenges:

- Not enough staff to handle workload is a resounding #1 challenge, chosen by 28% of participants, up from only 16% last year!

- A new entry to capture the difficulty supporting home agents landed at #2, chosen by 19%.

- Increasing contact volumes had not been a pressing problem for many in the past (hovering around 10% of participants). Of course, this year it exploded for many; 17% cited it as a top challenge.

- The perennial # 1 or #2, attrition, dropped to #6 at 15%, down from 27% in 2020! Whether that means attrition has decreased (high unemployment rates can do that) or centers had bigger challenges (or both!) is anybody’s guess.

- As other items grabbed higher percentages, some had to fall, and three others (besides attrition) stand out: high absence/low adherence (down from 16% to 11%), challenges with desktop tools (from 21% to 13%), and lack of understanding and respect for the center’s role (from 17% to 12%). Improvements in attendance and adherence help counteract other challenges and may be partly attributable to work at home. Keep the last one in mind when we get to the bonus question.

- By category, workload and performance items moved up while strategic and technology items moved down.

Priorities:

- Self-service maintained its #1 spot but with a slight drop from 24% to 22%. No doubt those seeking to implement it hope it will help with the #1 and #3 challenge double whammy of too much volume and not enough staff.

- A new entry to implement better home-agent support, tools and processes was selected by nearly 20%, aligning well with its challenge counterpart.

- Similarly, staffing to match workload jumped up about 4 percentage points, another strong alignment with the #1 and #3 challenges.

- The popular focus on employee engagement and empowerment dropped a bit, down over 4 percentage points.

- Addressing security/fraud/regulatory requirements dropped by over 6 percentage points.

- While several items dropped by a few percentage points, one of the biggest drops was in raising awareness of the center’s vital role and impact, noted by only 9% this year. Our bonus question shows that COVID took care of that for many. By category, strategic items moved down the priority list.

While those highlights show some good alignment, a few misalignments to note are:

- While not enough staff was a resounding #1 challenge, its direct counterpart on the priorities side of gaining budget approval for additional staff was chosen by 40% fewer participants. They may look to other actions like self-service to tackle that problem, or perhaps hope the staffing challenge is a temporary thing.

- Omnichannel ranks high on the challenges list but relatively low on the priorities list.

- Poor cross-departmental collaboration suffers perpetually from its high-challenge, low-priority standing; this year is no different.

- Performance tools get much higher priority ranking than they do challenges. Perhaps it is just time to get them implemented, and those tools can help tackle other challenges.

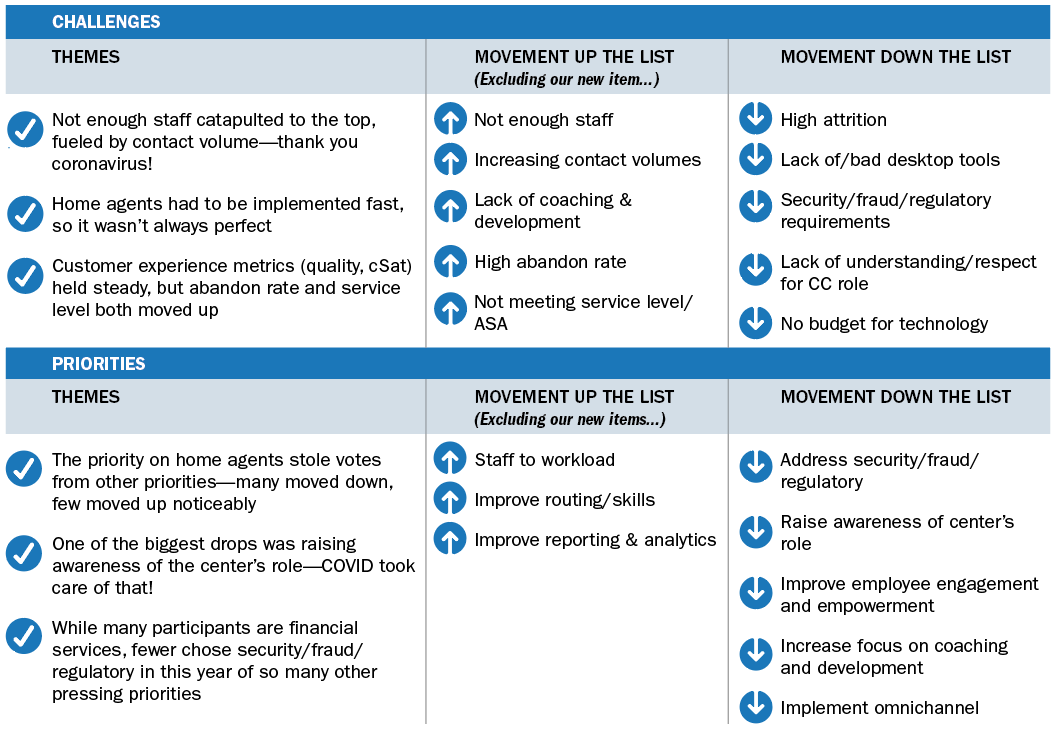

Table 1 provides our “movers and shakers” and summarizes a few themes in each category.

Table 1: Movers and Shakers in an Unpredictable Time Here are interesting comparisons between results from our 2021 survey and those from 2020. The overall theme for 2021 is: It’s all about the response to COVID and its impacts.

Top Contact Center Challenges

Many of our survey participants draw a line from COVID to the top three challenges. Volume increases hit hard and fast in many industries, rendering them short-staffed. And almost everyone moved most, if not all, of their agents to work from home. For some, it was an untenable situation that was surpassed only by the risks of working in the office and putting lives in jeopardy. So, while the top three are newly anointed, they are not surprising given the year’s events. Combine the next three challenges—self-service, omnichannel and attrition—with the first three, and you have a perfect storm.

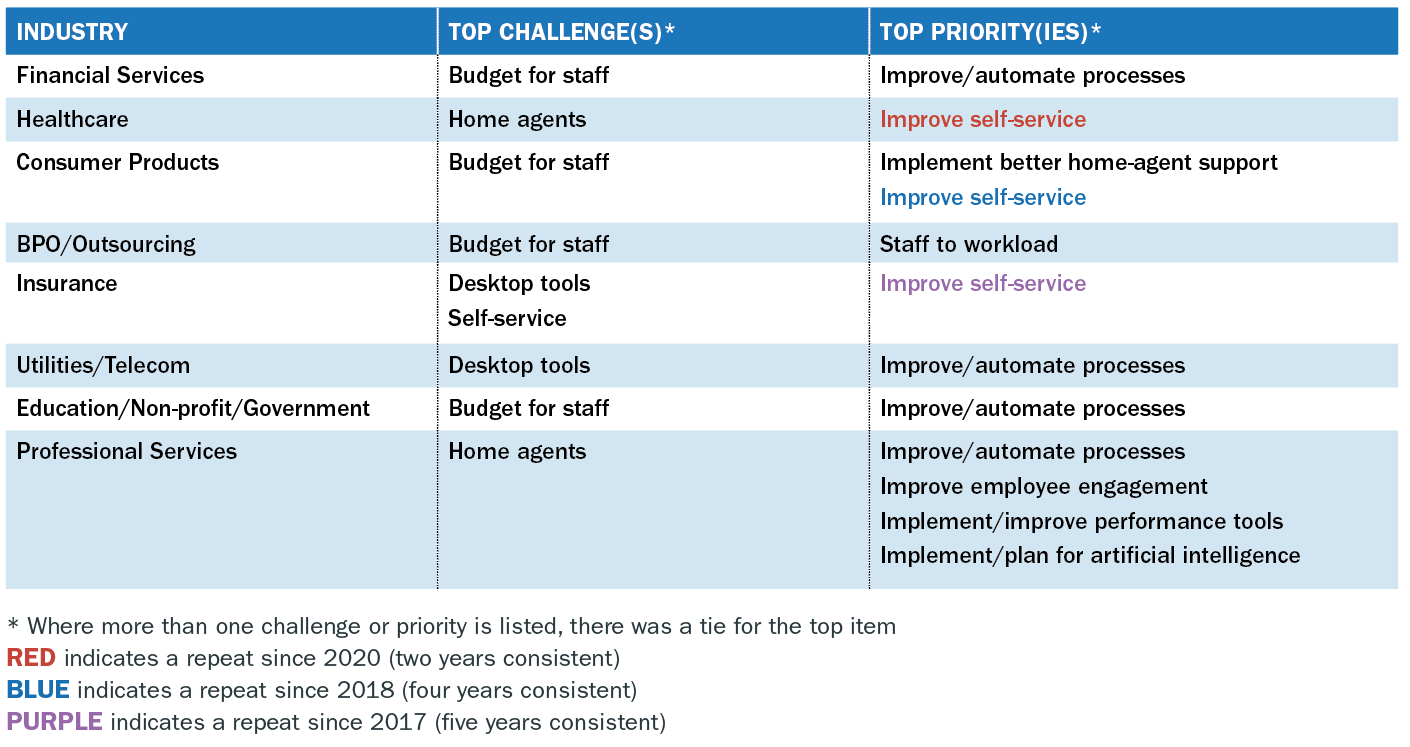

Challenges by Industry

You don’t show up as the #1 challenge by a 9-point gap without being chosen across industries. Only Healthcare, Insurance and Utilities/Telecom had fewer than 20% choose inadequate staffing. BPOs and Education/Non-profits/Government made it a strong “winner” at 44%. Nearly 40% of Healthcare participants indicated supporting home agents is what keeps them up at night, perhaps compounded by HIPAA requirements.

You can see the top challenges by industry in Table 2. We normally color-code trends over the years but there were no repeat top challenges in any industry!

Table 2: Industrial Views

Top Contact Center Priorities

Self-service again showed up as a top priority, and perhaps this year the reasons are most glaring. Without good self-service, centers are more vulnerable to sudden volume increases and staffing shortages. The next few priorities are all related to finding ways to handle an increased workload and keep staff happy and productive under the most trying times. Process improvements can lower handle times. Employee engagement and coaching and development are critical to everyone’s success.

I had to abandon my “year of the agent” theme for 2020 but I think it is still alive and well in the priorities. Center leaders haven’t abandoned their focus on staff and know that the path to great customer experiences goes through the heroic frontline staff who have endured so much in the past year. They won’t all be back together soon, but they are still a team.

Priorities by Industry

The priorities by industry show a bit more trending than the challenges, specifically for self-service. Insurance (57%!) and Consumer Products keep elevating that priority, and Healthcare had a repeat from last year. Many industries indicated process improvement as a top focus for 2021.

We invite consultants and industry analysts to participate in the survey, sharing a perspective that can cross industries. They expressed a variety of priorities and differed from the verticals, which would generally be represented by contact center leaders. For example, they noted AI at a relatively high rate (22%), matched only by the BPOs (who often sell AI-based technology capabilities).

You can see the top priorities by industry in Table 2, with a few color-coded trends emphasizing self-service’s staying power.

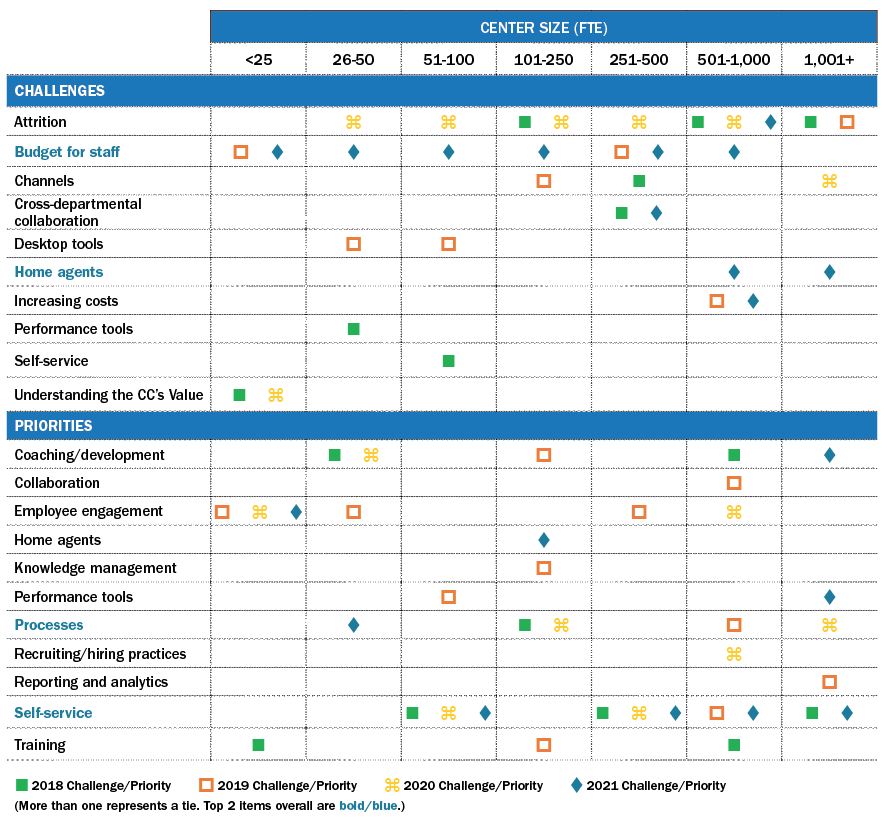

Priorities by Size

The largest centers (above 250) consistently indicated self-service as a top priority, as did the 51-100 band. All bands are above 16%. Nearly 35% of the 26-50 seat centers prioritize process improvements. Beyond that, there was little trending or alignment by size.

You can see the top challenge by size in Table 3. The trending in self-service shows for mid-size and large centers. The smallest centers continue to focus on employee engagement and empowerment.

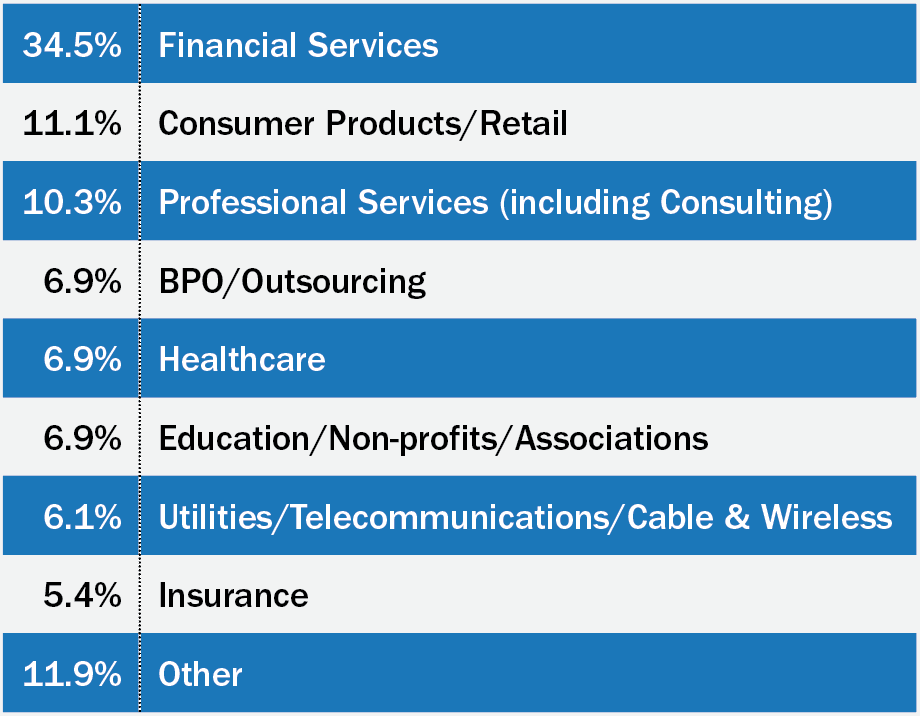

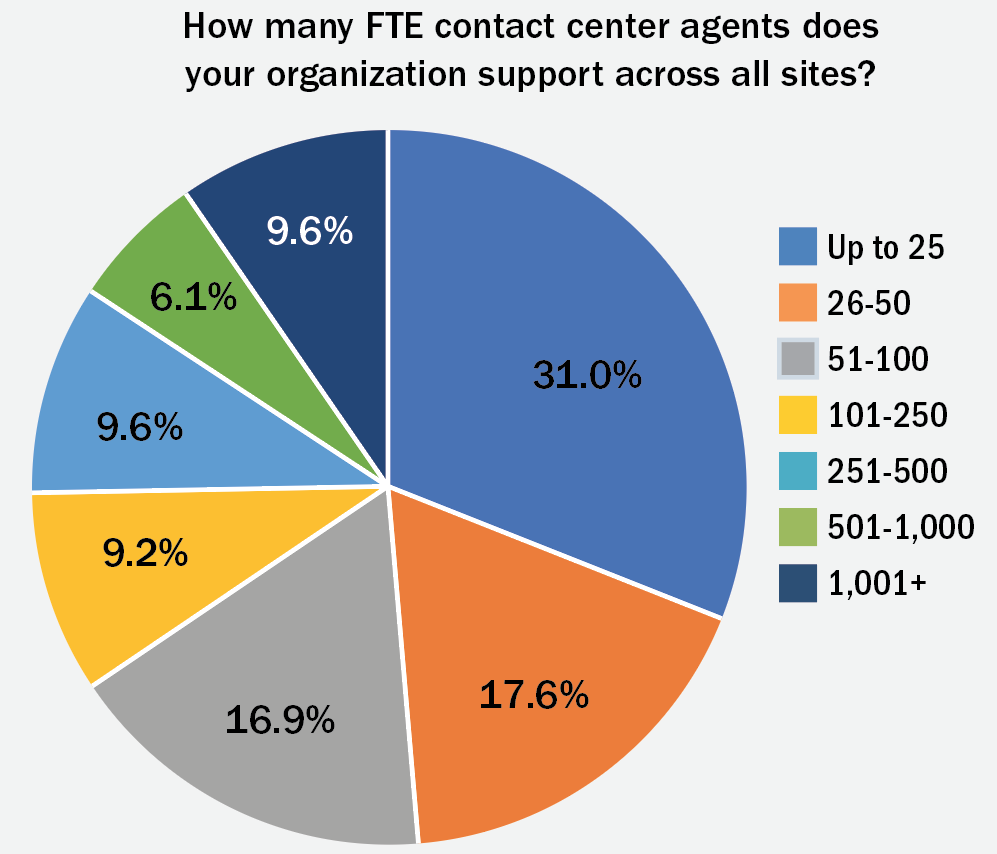

Survey Participant DemographicsContact center management and executives are the majority of participants (54%), followed by corporate executives (16%) and consultants (11%). The balance was operations support managers/analysts (6%), team lead/supervisors (5%), and a variety of “Other” roles such as IT, HR and training (7%). Figures 3 and 4 show the industry representation and distribution of center sizes. The sizes are a fair depiction of what we see in the industry—many centers under 50 seats and fewer over 500 seats.

Figure 4: Survey Participant Size Distribution

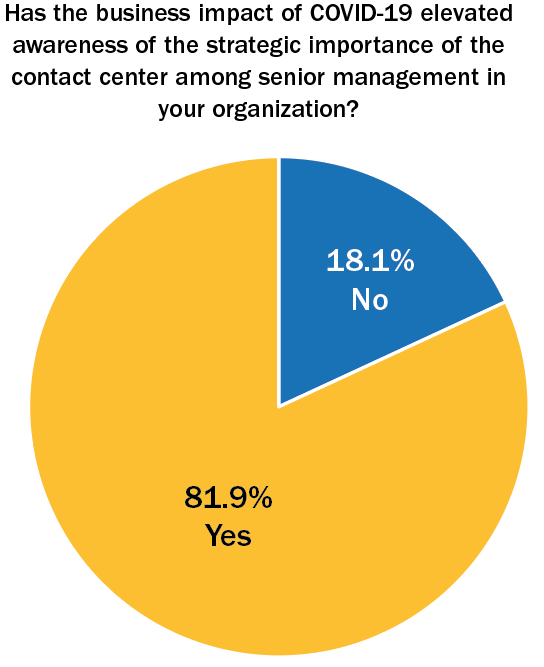

Bonus Question: COVID Raised Awareness of the Contact Center Role

We added a bonus question this year: “Has the business impact of COVID-19 elevated awareness of the strategic importance of the contact center among senior management in your organization?” Figure 5 shows the resounding “Yes” we heard in response.

Figure 5: COVID Raised Awareness of the Contact Center Role

We evaluated responses to the bonus question regarding raised awareness of the contact center’s role by size and vertical. Here are two points of interest:

- The Yes response was consistent across sizes, with the two largest size bands having the most positive (100% and 88%). The smallest were around 80%, and the lowest band was 251-500 at 75%.

- The verticals saw a bit more variation. Three were over 90%—Financial Services, Healthcare and Education/Non-profit/Government. The lowest was Utilities/Telecom/Cable at 69%.

As noted in the overview, the challenges and priorities also reflect a drop in strategic items, perhaps because COVID shined a light on the center and brought them this new-found awareness. We’ll take that “silver lining” of these unprecedented times. Centers need to leverage and maintain that momentum going forward as they sustain or create a “new normal” with home agents, enhanced self-service and more.

Lori Bocklund is President of Strategic Contact, an independent consulting firm that helps companies optimize the value of their customer contact technology and operations.

– Republished with permission from Contact Center Pipeline, http://www.contactcenterpipeline.com