From Best-Of-Breed To Standalone To Suite

Strategic Contact.

As companies make decisions about sourcing for new contact center technology, a crucial question to answer is whether to pursue “best-of-breed” (BoB) solutions or solutions that are part of a “suite.” Acquisition, innovation and expansion among technology vendors has made sourcing distinctions increasingly complex. With IT departments facing resource constraints and contact center operations desiring more control, suites seem to be the default choice to help all stakeholders meet their goals. Many wonder if the decision between suite and bestof-breed is still pertinent.

In this article, we will look at what’s happening in the marketplace and what it means for the various sourcing definitions, why organizations are moving toward solution suites, and where best-of-breed or standalone options fit.

MANY PIECES TO THE PUZZLE

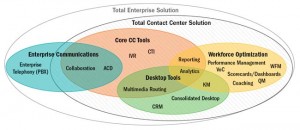

Typically, we think of two primary contact center technology market categories—core contact center solutions and workforce optimization (WFO). The core solution includes the ACD, IVR, CTI, reporting and variations such as multimedia routing and reporting. The WFO suite includes WFM and QM, as well as speech, text, desktop and data analytics, and performance management components such as agent scorecards with integration into coaching and learning management. Yet many companies and vendors consider both of these categories as a total suite and expand the concept in two directions. The core contact center solution can be combined with the enterprise telephony and collaboration for a complete unified communication (UC) suite solution. The agent desktop can be simplified through an integrated suite that includes CRM, a consolidated desktop and/or KM. Figure 1 shows this complex puzzle.

ORIGINS

The concepts of suites and BoB preceded the cloud/hosted marketplace. It was all about premise-based solutions that required fairly significant IT involvement. BoB was common when manufacturers had a more narrow focus. For example, there were “CTI vendors” or “IVR vendors” and “WFM vendors” or “QM vendors.” BoB worked well for larger companies with sufficient IT resources to manage integration and support. Companies purchased individual technology components such as an Avaya PBX, Genesys ACD/CTI/Reporting, Periphonics IVR, IEX WFM, and Witness QM (to use some legacy company names!). These buyers needed sophisticated features and functions that the BoB products offered.

Suite solutions appealed to small and medium companies wanting to go farther, faster, and to those without the internal resources to implement and maintain the complex BoB environment. Suite solutions became more affordable and provided capabilities previously unavailable to small and medium companies. Conceptually, the tradeoff was considered to be a complex BoB environment with advanced features or a more easily supported environment that might be missing some of the bells and whistles.

EVOLUTION

As companies of all sizes are driven by a desire to go far and fast with strained IT resources, suites have taken over the market on many levels. Yet even the definition of a suite has split into two categories: built as one and integrated into one.

“Built as one” are solutions built from the ground up as a single, total solution with one interface into all applications. For example, Interactive Intelligence introduced a single solution in 1994 with an “all-in-one” message that delivered broad functionality on a single platform. They started with PBX, ACD, IVR and reporting and then expanded to WFM and QM. They continue to add functionality. Genesys has similarly built out a suite with extensive functionality, but from a different angle as they started as a best-of-breed CTI vendor. Some cloud solutions such as Five 9 and inContact have built out suites but tend to build the “core” functionality (multichannel ACD, IVR, CTI) and partner or purchase for WFO.

Technology Puzzle

“Integrated into one” solutions rely on vendor integration, but often have multiple interfaces for system administration. These solutions are often the result of an acquisition strategy to add functionality to offerings in pursuit of the suite, especially for WFO elements. In some cases, an interface (or wrapper) to the various systems has been consolidated into a single view. An integrated solution does not always carry full functional capability of the original components. Examples of the integrated approach include Aspect and Mitel.

The suite concept has also expanded as vendors add to their product lines. Vendors may offer a total suite that meets all contact center needs or a subset where the different “suites” have to be integrated. For example, contact center vendors have a renewed focus on enterprise communications (aka “Unified Communications” or “Business Communications”) combined with contact center. Contact center and WFO vendors are increasing partnerships and level of integration with CRM or adding CRM and/or KM functionality. CRM vendors can manage all media except for voice.

Best-of-breed has evolved, too. There are few true BoB left, but there are BoB suites (and yes, we get the irony!), and then there are standalone players. Traditional BoB vendors have led the market in acquisitions, product expansion, and feature/function expansion such that most market leading vendors have become suites—or vendors of a suite of BoB products. For example, Verint and NICE are best-of-breed WFO solutions that offer a suite of components for a total WFO solution. Verint is even stretching into the core contact center solution market with media management for all but voice (which they continue to rely on partners for, such as Avaya or Cisco). However, there are still standalone WFM vendors in the market (e.g., injixo, Pipkins). These standalone vendors are not always the “best-of-breed,” but they may compete on factors other than the best functionality such as cost, ease of deployment, focus and value-added services. As another example, there are analytics suites that are part of larger WFO suites that include desktop, text and speech analytics along with dashboards/scorecards for display. Nexidia and Callminer still exist as standalone—and by most views, BoB—speech analytics vendors. Knowledge Management solutions are examples of a different market evolution as most vendors have been absorbed into other vendors’ suites, whether CRM, WFO or other.

There are, of course, exceptions to every rule. The impression still exists that suites are not BoB as they lack the most advanced capabilities or at least lag the market in adding them. Vendors (or their value-added reseller (VAR) partners) fill perceived or real gaps by partnering to build out suites through pre-integration. These vendors/VARs typically sell the solution with a single point of contact message (or “one back to pat”) but may then serve as a conduit to the partner vendor support organization(s).

WHY SUITE?

There are many reasons why both buyers and sellers migrated to a suite focus. Overall, it’s a drive for simplicity and the associated time, resource and cost benefits. Suites have an appeal since vendors are moving to more user friendly administration and a single administrative interface for all components that includes crossfunctionality between components (e.g., enter a new agent once for their skills, schedule and performance tracking). Suite solutions offer “seamless” upgrades and component integration. Suites can offer the “one throat to choke” for implementation and support that nearly everyone seeks. Many of these same requirements drive the desire for cloud solutions—get in quickly and at low cost, with a broad set of capabilities that are relatively easy to administer.

WHY STANDALONE?

We will never get completely away from standalone solutions, and cloud-based solutions have breathed new life into some of these options as people pursue point solutions to fill gaps quickly with little startup cost. Standalone solutions can offer a better price, such as injixo for WFM. They can offer specific bells and whistles (e.g., Pipkins focus on back-office functions; Nexidia for advanced analytics). Standalone solutions can appeal when you need to add a component but not replace the entire suite due to protecting current investments or custom integration that makes replacement too complex. Standalone can be the right path to try something quickly at a low cost (e.g., web chat through LivePerson or BoldChat) or when a company intends to grow with a new vendor over time to achieve a suite solution but needs to spread the investment over several years.

FINDING YOUR PATH

We seem to be at a turning point in the industry. Companies tend to make decisions in the moment, to meet a specific need or situation. There are struggles with IT and business biases and preferences. IT resources are constrained, so contact center operations are taking more control over their destiny. Vendors are consolidating and filling functional gaps in a variety of ways: build, acquire, partner, integrate and sell. Defining a roadmap that guides technology sourcing can be difficult. However, even with these dynamics, the goal should be to have a defined strategy that leads to a consistent approach. And with a strategy, even when a need or opportunity—to deviate arises, it should lead to a more thoughtful evaluation and understanding of the tradeoffs, risks and impacts.

The bottom line is that in today’s complex and ever-changing market, buyers need to be informed but agile. Frame an overall sourcing approach that fits your business, but adjust to the situation—both yours and the vendors’— when needed.

– Reprinted with permission from Contact Center Pipeline, http://www.contactcenterpipeline.com

DON’T FORGET THE PBX

Companies look for some level of vendor consistency but struggle with where to draw the line when it comes to the enterprise PBX.

Through acquisition or siloed purchasing, many companies have a variety of solutions that they want to rationalize to a single solution. Here are some strategies we see among our clients.

MAXIMIZE CONSISTENCY: Some seek maximum consistency and use the data network vendor as the default choice for enterprise telephony, collaboration, contact center and WFO tools.

Maximizing consistency typically leads to an environment dominated by Cisco and their partners. Total consistency is sometimes difficult to achieve with collaboration solutions as the most common solution is Microsoft, not Cisco.

PBX AND COLLABORATION CONSISTENCY: Many seek PBX and collaboration consistency across the enterprise (although it may be different vendors for each), but will use a separate vendor for the contact center.

PBX and collaboration consistency is increasingly common as contact centers pursue cloud solutions. Companies achieve consistency for call control (including transfers) throughout the organization and use a consistent solution for easy collaboration across the enterprise, including the contact center. With this approach, the contact center solution is integrated with the enterprise PBX and may also integrate with the collaboration tool at the desktop.

ENTERPRISE AND CONTACT CENTER WITH SEPARATE SOLUTIONS: It’s increasingly rare, but some still have a business enterprise PBX with a separate PBX and contact center solution.

Separate solutions occurs when contact centers pursue cloud solutions and cloud solution vendors offer PBX, collaboration and/or contact center capabilities. As in the other options, the collaboration may be from a different vendor or a common vendor to the PBX solution, with the latter growing as more companies use Microsoft Skype for Business (aka Lync). The enterprise and contact center PBXs, and the collaboration tool, have to be integrated to achieve call transfers, visibility and collaboration between the contact center and the enterprise, which can be challenging. The value of a separate PBX is contact center capacity protection and control.